Payday Loan: Installment or Revolving?: How to Make Your Paycheck Loan Cheaper

Many states now offer payday installment loans for a duration of several months and maximum amounts above $2,000. Is it a safer and cheaper alternative to traditional payday lending – or just another trap to make you pay more?

Revolving Loans vs. Installment Payment Loans: Understand the Difference

Installment Loans

An installment loan is paid off in installments – regular portions of equal size. The total amount you’ll have to pay, the interest rate, the duration, and the payment schedule – it’s all fixed.

If you can’t make a monthly payment, you can often ask for an extension. Note that you’ll still accrue interest for the month you’ve skipped.

Mortgages, student loans, and car loans are good examples of installment loans. In the past few years, installment payday loans have also become common. Keep in mind, though, that unlike mortgages, they don’t help to improve your credit history.

Revolving Credit

With revolving credit, you borrow money as you need up until a certain limit and pay it off regularly, but there is no set installment size or end term. It’s fine to use revolving credit as long as you pay off your balance regularly and, preferably, in full. But if you don’t pay what you owe at the end of the month, the outstanding balance will be rolled over to the next period, and you’ll pay more in fees. That’s the main problem with revolving loans like credit cards and payday loans.

A rollover is an automatic renewal that happens when the payday loan isn’t paid off in full at the end of the period. Essentially it’s a loan extension with extra fees. Renewal is a more general term than rollover (you can renew a loan after paying it off in full, for example), but in payday lending, the two terms are used interchangeably.

How Rollovers Damage Your Finances

In the past, payday lending was a classic form of revolving credit. Recently, installment payday loans have emerged in many states, and we’ll talk about them later.

With a standard paycheck loan, you’re supposed to pay off the debt in full when you receive the next paycheck. However, creditors purposefully make this difficult, because they want you to keep making rollovers. To achieve this, they use two tools:

- Short duration: it’s hard to come up with the whole amount plus fees in just two weeks;

- Single payment: you can’t pay part of what you owe after a week, for example – it has to be all at once or nothing. Even if you come into some money in the middle of the borrowing period, you’re likely to spend it on something else – and arrive at the debt payment day with nothing.

Why are rollovers bad for your finances? Here’s an example: you’ve borrowed $400 for two weeks, and the fee is $50. If you can’t pay and have to do a rollover, you’ll pay just the $50 fee, but two weeks later you’ll still owe the principal ($400) plus the new fee ($50). The total cost of the loan increases from $50 to $100, and the more rollovers you do, the more the costs will mount.

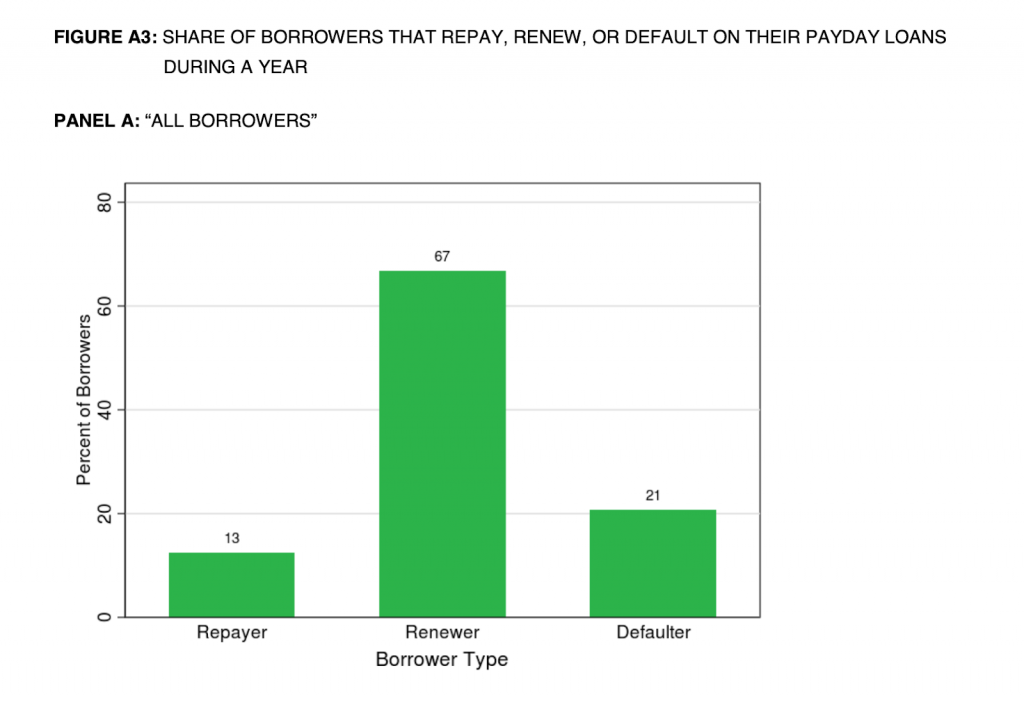

Unfortunately, according to CFPB, 80% of all paycheck loans are either rolled over or renewed shortly after paying off the previous loan. An average payday borrower spends $520 in fees to pay off a $375 debt – with an average fee of $55 for two weeks, this means rolling over the debt more than 8 times!

Installments as a Response to Regulatory Pressure

Regulators keep pressuring payday lenders to improve borrowing terms. In some states, rollovers are banned or limited to just one (to learn more about how payday loan terms differ by state, read this guide).

In response, credit companies came up with payday installment loans, which quickly gained popularity. In fact, a large survey found that 90% of people believe payday borrowers should be able to pay in installments.

According to the Pew Trust, creditors in 26 states already issue such loans: for example, Texas has both single loans (due within 2-4 weeks) and multiple installment loans for up to 6 months. In some states, installments are allowed only above a certain threshold (e.g. $2,500 in California and $2,000 in Alabama). On the surface, they look much better than your average paycheck loan:

- Repayment period ranging from 1 month to a year or longer;

- Higher maximum borrowing amount (up to $2,000 or even more);

- Lower nominal APR.

However, in spite of their popularity, installment loans aren’t what they purport to be.

The 3 Risks of Installment Payday Loans

- Higher loan amounts keep you indebted longer, so even at a formally lower APR you may end up paying more in fees. For example, in Ohio, where the interest rate on short-term loans is capped at 28%, payday lenders issue loans for 26-34 weeks with the APR ranging from 275% to 360%.

- The feeling of false security makes users more likely to take out other loans of different types, increasing their debt burden, as a recent study found.

- Since installment loans look ‘respectable’, creditors can now target higher-income users with better credit scores.

Should You Pay for Rollovers or Take out a Payday Installment Loan?

With a regular 2-week payday loan, you risk spending hundreds of dollars in fees if you have to roll it over multiple times – perhaps more than you’ve borrowed in the first place. For this reason, rollovers are banned in many states, including California, Florida, Michigan, Ohio, and Texas. By contrast, legislators encourage payday installment loans as a way to protect consumers.

Overall, payday installment loans can be safer and cheaper than regular paycheck lending. However, installment loans also carry risks. Remember that payday lenders introduced installments to avoid problems with regulators, not to make debtors’ life easier. So, while an installment payday loan can be easier to repay, you shouldn’t treat it as a regular installment loan issued by a bank.

If you do decide to use installment-based payday lending, follow these three rules:

- Use a cheaper alternative if possible: payday loans should be an emergency solution.

- Only choose a loan that you can afford. Data shows that monthly payments can be very high even for longer loans.

| Lender (State) | Loan Amount | Total Cost | Loan Duration | Loan Duration |

|---|---|---|---|---|

| ACE Cash Express (TX) | $600 | $586 | Four months | $297 |

| CashNetUSA (NM) | $600 | $952 | Seven months | $222 |

| Advance America (WI) | $500 | $595 | Five months | $219 |

| Plain Green Loans (mult states) | $500 | $578 | Six months | $180 |

| Speedy Cash (IL) | $500 | $542 | Six months | $174 |

| Colorado | $500 | $290 | Six months | $130 |

- If your creditor doesn’t charge an early payment penalty, try to repay as soon as you can. By paying a bit more than the minimum amount every month, you can get rid of the debt sooner and save on fees.

So, what’s better for the borrower: a revolving payday loan or installments? In the next few years, most payday lending will probably switch to the installment model, and that is probably a safer option for you, too. However, remember that an installment payday loan can also be very expensive and should be used only as an emergency tool when you can’t get a cheap loan anywhere else. For detailed information on the payday lending regulations in your state, see our Law & Legislation section.